What are Support and Resistance Levels in Forex, Indices, and Commodities

Support and Resistance Levels in

Forex, Indices, and Commodities

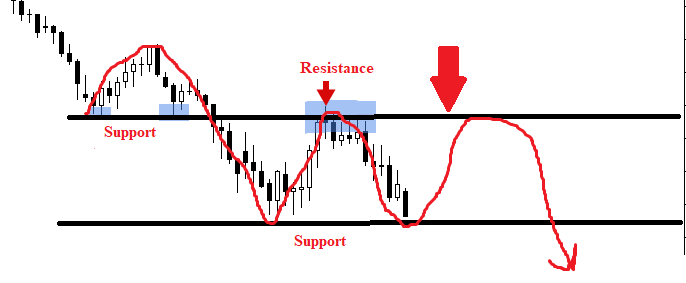

Price

makes a zigzag pattern on any trend chart as it moves up and down. Anytime the price

goes up, then pulls back (high-high and high-low), the high point is the

Resistance. In simpler terms, it might represent a price level where a

potential uptrend pattern is reversed as a minor or major sell-off. As a

result, any pair's resistance levels indicated a potential presence of sellers'

surplus.

After

the sell-off, the lowest possible point the price reaches before it begins its

journey back is the Support. In simpler terms, it is the price level where a

potential downtrend paused due to a surplus of buyers. It implies that Support

and Resistance are created as the price moves up and down on a trend chart.

How to trade with Support and Resistance?

After

a thorough technical analysis and confirmation that the pair is in a continuous

uptrend, buy when the price touches the Support and sell where the price

reaches the Resistance.

What Indicators for Support and Resistance?

Admiral

Support

Wolfe

Waves

Fibonacci

Support and Resistance